With extra resources obtainable at our fingertips than ever earlier than, consumers have far more direct access to knowledge and expertise that had been previously the domain of a restricted variety of gatekeepers. As a end result, MasterCard, for example, observed a 40% enhance in contactless payments within the first quarter of 2020. A nice example of this is Mint, a private finance management system that uses the information from bank accounts to assist folks track spendings. The recognition of FinTech options retains on growing, and one cannot however benefit from it. In the UK, for instance, using FinTech apps amid the pandemic grew by greater than 50%, in Europe this quantity is 72%. The monetary sector’s concentrate on automated defenses, built-in frameworks, and preparedness plans is crucial.

This fast processing capability might lead to the event of more advanced trading algorithms, probably increasing profitability. Decentralized Finance (DeFi) and Distributed Ledger Expertise (DLT) are on the forefront of the monetary revolution, looking for to decentralize and reshape the worldwide financial markets. At the second, the evidence exhibits DeFi experiencing an unprecedented CAGR of forty two.6 %, which is far greater than another industry (see Fig. 3). In turn, according to Statista, the DLT market can be experiencing a major progress fee financial technology trends and is anticipated to achieve $140 billion by 2030.

Instant Funds Disrupt The Eu’s Cost Panorama

The rise of sustainable expertise in fintech aligns with the broader company and client concentration on ESG initiatives. A Global Sustainable Investment Alliance (GSIA) research shows that sustainable investment is climbing, with buyers increasingly contemplating ESG elements of their funding decisions. Fintechs are responding to this demand by integrating ESG criteria into their platforms, allowing traders to screen investments based on environmental and social factors.

Ai And Ml For Monetary Technologies

With the rise in data sharing, there’s a heightened focus on making certain consumer safety and information security. Forbes highlights that the future of open banking depends considerably upon building and sustaining shopper belief. This includes highly effective encryption methods, secure data storage solutions, and clear privacy policies. It additionally means ensuring compliance with rules just like the GDPR (General Information Safety Regulation) to protect personal knowledge. As open banking positive aspects traction, regulatory frameworks globally are evolving to accommodate and promote this alteration whereas ensuring shopper safety and data security.

It will also depend upon steadfastly pursuing security and shopper protection. Moreover, the industry’s ability to innovate and meet customer demands will be crucial. Generative AI in finance represents a transformative shift in how monetary services operate. It delivers individualized customer experiences and optimizes operational effectivity. This technology continues to revolutionize the sector by offering deep insights into spending patterns. By utilizing alternative knowledge, the service supplies extra inclusive access to monetary merchandise for shoppers with restricted or nontraditional credit score histories.

To combat these threats, many institutions are turning to synthetic intelligence and machine studying options. Nearly 35% of organizations surveyed by Deloitte cited errors https://www.globalcloudteam.com/ and errors with real-world consequences as the highest potential barrier to adopting generative AI. Financial institutions, which operate in a highly regulated surroundings, have been slower to roll out AI-driven buyer experiences in comparison with other industries. For example, Zest AI, a man-made intelligence-powered platform, makes use of machine studying algorithms to foretell and prevent fraudulent transactions in real-time. Payoneer, a worldwide payment platform, provides immediate access to earnings for freelancers and contractors worldwide, simplifying cross-border payments.

Lastly, we think fee processing, especially between businesses, is ripe for innovation. Usually, such functions usually are not banking products and so they additionally don’t permit the issue of a debit card, make deposits or apply for a mortgage right within the app as API-banking-based apps do. As An Alternative, they permit accumulating real-time financial knowledge from a number of finance accounts, ascertaining credit rating ratings, reviewing transactions, and comparable. In brief, they allow individuals to get a more detailed view of their present monetary scenario primarily based on the actual information from their bank account iot cybersecurity.

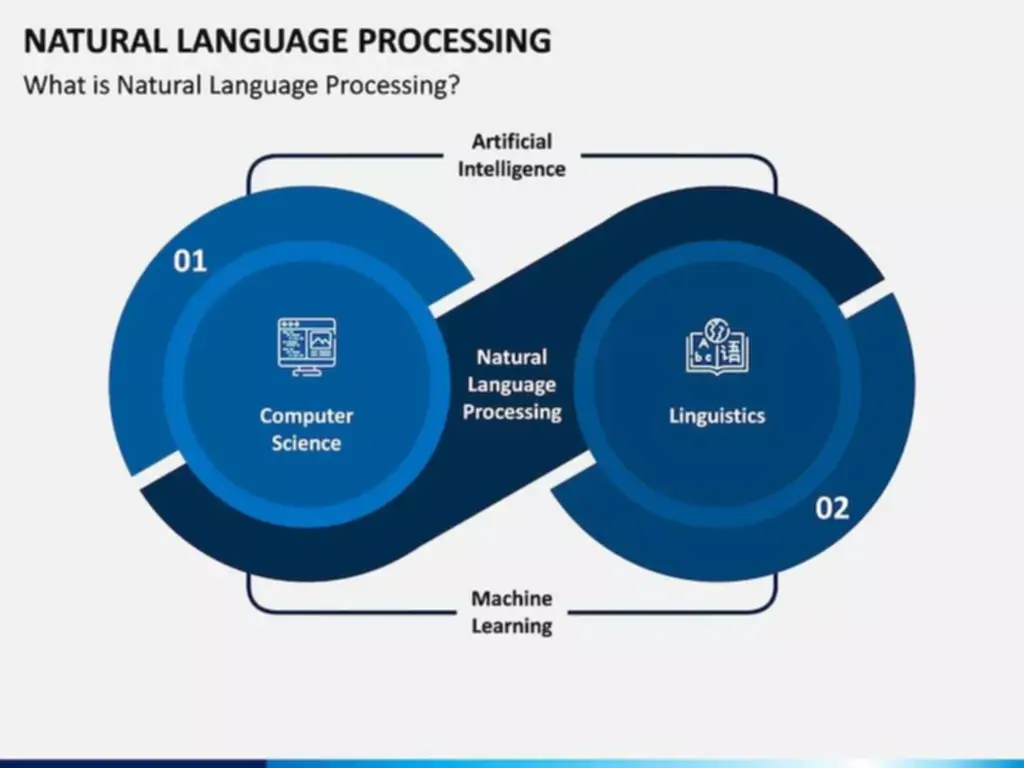

Artificial Intelligence And Machine Learning

Regulatory sandboxes promote innovation and provides clear path, making it simpler for fintech startups to bring new ideas to the market. Artificial intelligence and machine learning are more and more becoming a part of financial providers, offering options such as predictive analytics, danger administration, and customised buyer experiences. Monetary institutions are using AI to course of large volumes of knowledge, making credit scoring extra correct, detecting fraud, and automating customer support.

The time to get to market takes longer and the issues are typically extra advanced, however the alternatives to create optimistic change via a community effect are tremendous. The largest development impacting the industry proper now was actually the latest announcement from the big custodian banks. They have finally matched the commission-free capabilities of fintech corporations which have been providing these issues for some time now.

- The practice makes it attainable for companies to supply services like payments, lending, or insurance coverage without referring clients to exterior monetary institutions.

- The relationship between growth in the freelance economic system and fintech can also be often overlooked in personal finance product design.

- Testing automation also helps scale check coverage throughout extra device/browser combos so prospects receive a excessive quality digital experience regardless of system.

- All of these embedded finance solutions will profit fintech organizations and banks and at the identical time encourage healthy competitors in monetary and different industries.

At Riverty, we’ve designed our options with users first, empowering businesses to navigate this shift. As detailed in Fintech 2040, this transformation in the future of fintech will impression your business technique. Uncover how this elementary shift will impact your corporation strategy and what steps to take now to remain related in this new panorama. Following the latest insights, the open banking market dimension will quickly skyrocket.

Embedded finance integrates payments, lending, and insurance into non-financial platforms seamlessly — from retail to ride-sharing apps. Stablecoins are promising fintech developments, digital currencies designed to maintain stability by pegging their value to an underlying reserve, usually a fiat currency like the united states dollar or a commodity like gold. This stability addresses a major problem traditional cryptocurrencies face—volatility—and brings several necessary elements to the forefront of the fintech business. Smart contracts are a exceptional FinTech growth with wide-ranging functions in the embedded monetary companies sectors. It manages and governs the execution of agreements that are made virtually between a purchaser and a seller.

AI and machine learning tools are used to analyze person habits to detect anomalies that would point out deception, assess customer satisfaction, and predict future financial needs. For example, AI can see uncommon transaction patterns which will indicate fraudulent activity, enhancing safety and improving belief. Sustainable expertise and green fintech represent a transformative shift within the monetary business. These applied sciences may considerably contribute to a extra sustainable and environmentally accountable financial ecosystem.

That’s why we partnered on Fintech 2040 – to form a future the place financial services work higher for individuals and businesses alike. As your cost companion, we’re creating a suppose tank where forward-looking professionals can collectively discover and shape the future of monetary services. We imagine the fintech ecosystem of 2040 won’t be defined by anybody firm – it’ll emerge from the ideas we dare to explore collectively. This paper marks step one in an ongoing journey of position papers, roundtables, and cross-industry dialogues that will help businesses not simply put together for what’s coming, but actively co-create it. In this Fintech 2040 analysis from Riverty, we reveal how AI, embedded finance, and cross-industry convergence will reshape monetary services over the following 15 years.